Microelectronics: Supply Chain Challenges with “The New Oil”

Microelectronics: Supply Chain Challenges with “The New Oil”

- Details

- Published: Wednesday, 06 April 2022 22:04

- Written by Michael Fritze, PhD

- Hits: 4707

A Shortage of Chips

The COVID-19 global pandemic has revealed the fragility of global supply chains. Business practices such as “just-in-time” supply chain strategies, so efficient during normal times, became serious liabilities in the face of supply disruptions, irrespective of their origins. Shortages of semiconductors (“chips”) have been but one of the many disruptions to ripple through the US economy in the wake of COVID-19, but one that was both highly consequential and surprising.

The COVID-19 global pandemic has revealed the fragility of global supply chains. Business practices such as “just-in-time” supply chain strategies, so efficient during normal times, became serious liabilities in the face of supply disruptions, irrespective of their origins. Shortages of semiconductors (“chips”) have been but one of the many disruptions to ripple through the US economy in the wake of COVID-19, but one that was both highly consequential and surprising.

The public quickly took note when in the summer of 2020 automobile inventory shrunk and prices rose sharply. Auto manufacturers, such as Ford, had to stop manufacturing new cars and trucks because they didn’t have the chips on which the vehicles now depend.1 Automotive chip shortages persist and the auto industry reportedly took a hit of $210 billion in 2021 alone as a result.2 These shortages were due neither to delays at port facilities, nor to chip production interruptions at foundries. Rather, just as with shortages of Personal Protective Equipment (PPE) and other goods, a fundamental cause was a dependence on foreign supplies and a failure to maintain sufficient inventory with assured resupply lines in times of need.3

Early in the pandemic, the automobile industry made the mistake of canceling orders in anticipation of much lower demand. Other industries were impacted by the shortage of microelectronics and continue to experience disruptions.4 The risks of relying on fragile supply chains reveals the potential of getting cut off from critically needed supplies in times of crisis. The pandemic highlighted the critical importance of securing US supply chains in the key industry of semiconductors.

National Security Implications

The ramifications resulting from chip shortages go beyond commercial inconveniences. Microelectronics are the foundation of the information economy, the underpinning of all information technology, and a prerequisite for advanced data science and telecommunications, which are all essential to a well-functioning society. But microelectronics is also at the heart of the US nuclear deterrent and conventional weapons systems, critical infrastructure and utility management, and all elements of national defense. Current supply chain disruptions have shown potential adversaries how serious damage could be inflicted on the US, as described in Al Shafer’s paper “The Canary in a Coal Mine.”5

To be clear, in times of war—whether it is military, economic, or political vectors of combat6 or whether it is a “gray zone” war or war of competition—dependence on foreign supplies can pose a major national security vulnerability. If supplies are cut off, as in the use of sanctions, manufacturers might be left using inferior parts. For weapon systems, inferior parts lead to inferior weapons. Adversaries might emplace kill switches into parts that are then incorporated into military equipment, giving attackers the power to defeat a system on command. Microelectronic parts, like software, are subject to cyber-attacks. Malicious insertions into microelectronics can enable foreign espionage, which can lead to information theft. Critical infrastructure might be disrupted in times of conflict: electric power or gas distribution might become unavailable. Communications might be disabled to hobble effective national responses.

The national security dependencies on microelectronics change our risk calculus. It is no longer just the losses of the automobile or consumer electronics industries. The security and surety of our microelectronics supply chain is an existential issue of national security, necessary for the protection of the nation from foreign influence, manipulation, and potential defeat.

However, the US Department of Defense (DoD) is no longer the driving force in research and market factors in the microelectronics field.7 The needs of the commercial marketplace have overridden the national security interests of the US. The risk of supply disruptions is a shared concern across the civilian, military, economic, and commercial sectors.

However, the US Department of Defense (DoD) is no longer the driving force in research and market factors in the microelectronics field.7 The needs of the commercial marketplace have overridden the national security interests of the US. The risk of supply disruptions is a shared concern across the civilian, military, economic, and commercial sectors.

Assured Access

Any solution must solve two issues with respect to the microelectronics supply:

- Provide a sufficient supply of state-of-the-art components upon demand, with guaranteed access even under adverse circumstances, such as a global pandemic or economic conflict; and

- Provide access to trusted parts free from counterfeits, defects, inferior parts, manipulations, or insertions.

The same issues apply to other sectors, but neither condition is currently satisfied for the microelectronics sector.

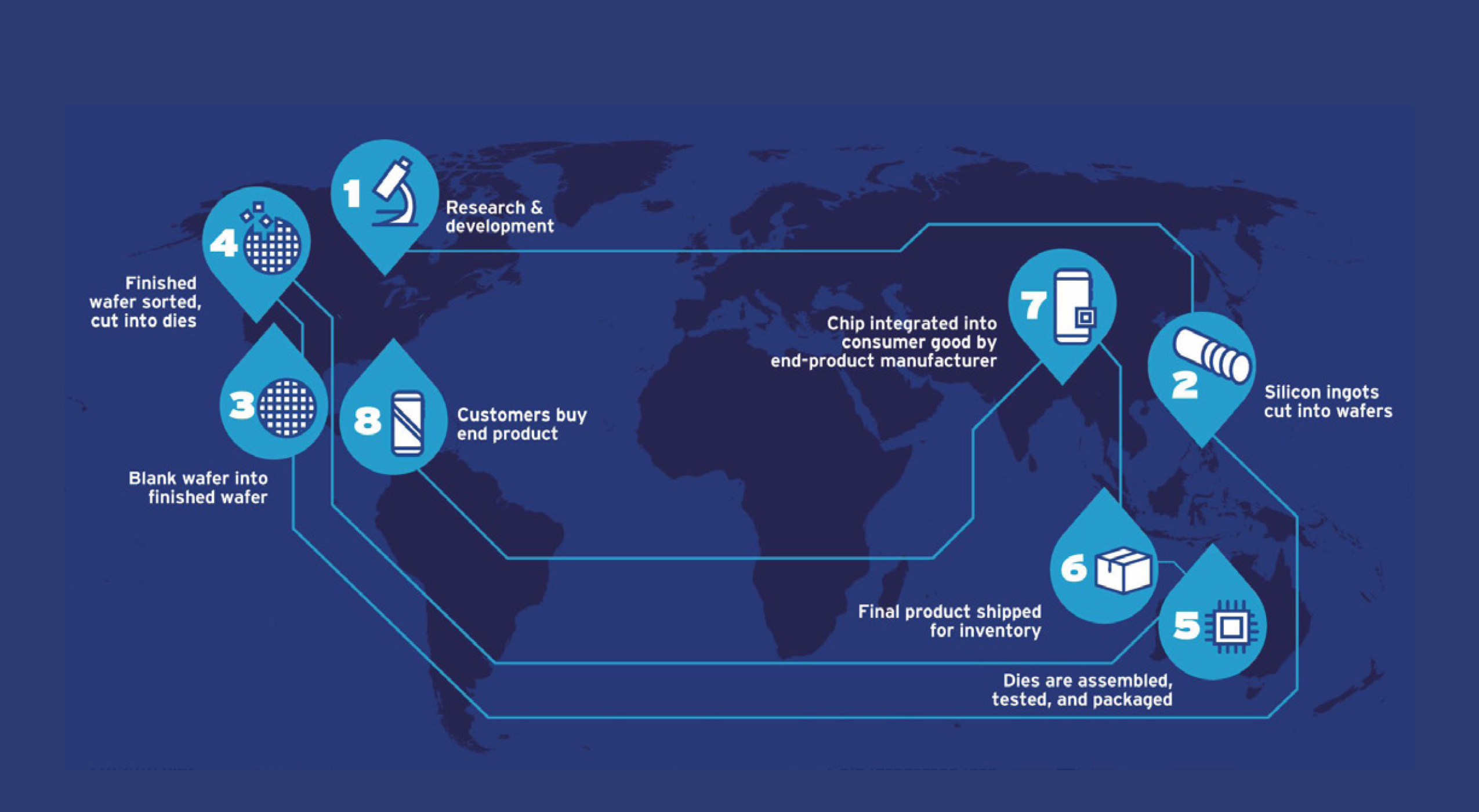

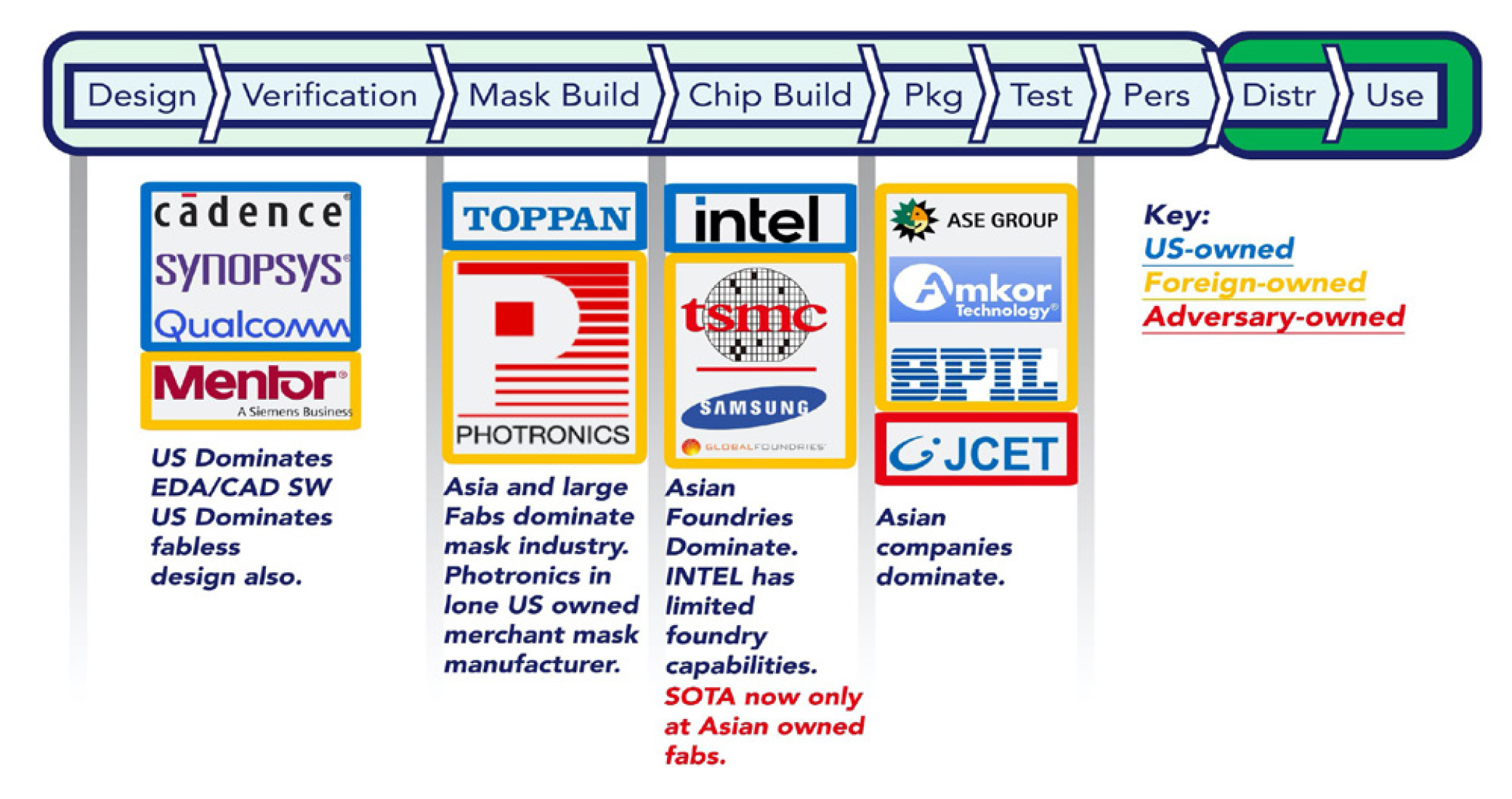

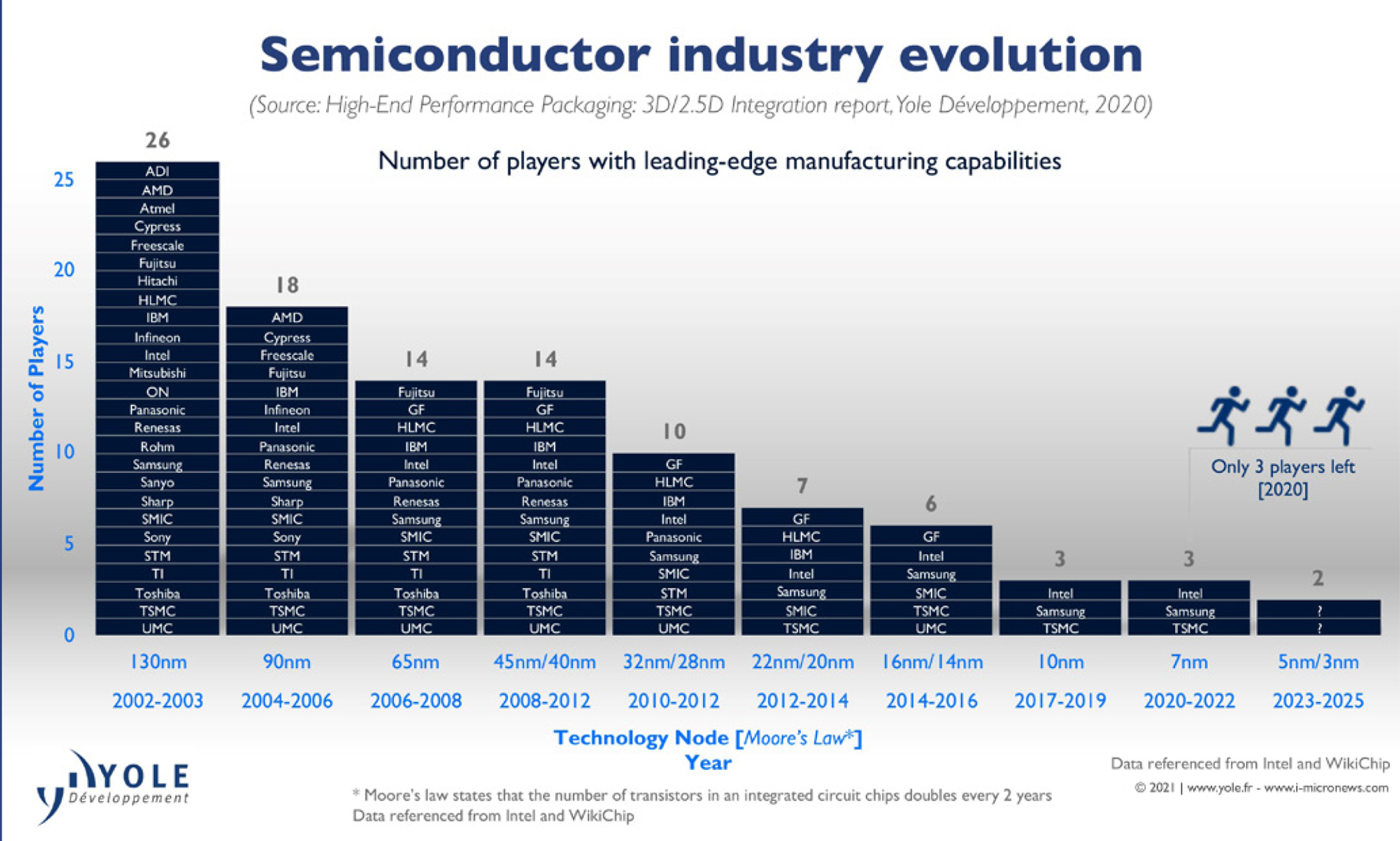

The US is highly dependent on overseas suppliers for key semiconductor manufacturing steps, particularly fabrication and packaging and test. The semiconductor industry is a highly globalized endeavor, wherein key supply chain elements are located around the world (see Figure 1). There are multiple steps required in the production and delivery of chips (Figure 2), with the “chip build” as the crucial step for the fabrication of the actual product. As a result of consolidation within the fabrication sector, Asian companies have dominated chip manufacturing (Figure 3). In particular, TSMC (based in Taiwan) holds a commanding 58% market share in the “pure play” foundry market,8 where the company manufactures semiconductors primarily for outside customers and not internal consumption. Today, the US still dominates in design and verification, and possesses some foundries, but the state-of-the-art components with the most recent developments are only manufactured in Asia.

Figure 1. Complex Global Semiconductor Value Chain Map. Source: Semiconductor Industry Association. Used with permission.

Figure 2. Semiconductor Supply Chain for Digital Logic (note the foreign dominance in fabrication and packaging and testing).

Source: Potomac Institute for Policy Studies

Figure 3. Consolidation of Semiconductor SOTA Fabs. Source: Yole Development. Used with permission.

Access to trusted microelectronics is even more challenging. Substitutions, insertions, or other tampering can occur at any point in the supply chain, and the fabrication step is particularly vulnerable. Historically, the US has used national security laws and classification authority to assure that the provenance and manufacturing of certain microelectronics parts was absolutely secure. However, with state-of-the-art fabrication facilities (fabs) all offshore, that level of security is no longer available for the most desirable parts.

China and Microelectronics

As part of the global competition in microelectronics, US adversaries are acutely aware of their own needs for assured access and trusted parts for use in their commercial, industrial, and military systems. China has been making very large investments to develop its own domestic semiconductor capabilities, as China is currently highly dependent on imports.9,10 They have recently established funds worth approximately $150 billion and $30 billion to support state-owned acquisition of foreign semiconductor production capabilities.11 They continue to invest in their own fabs and are stimulating the establishment of domestic fabless design companies. A modern fab facility run by TSMC has been established in Nanjing.12 China’s State Council issued a Notice on Several Policies to Promote the High-quality Development of the Integrated Circuit Industry and Software Industry in the New Era and has been instituting incentives and subsidies to promote their domestic semiconductor industry.13

Such subsidies pose a major challenge to the competitiveness of the US semiconductor industry. More than guaranteeing their own assured access to microelectronics, China’s large investments and acquisitions represent a plan to gain global economic competitive advantages in the microelectronics sector, as detailed in the “Made in China 2025” plan.14 As a result, China could, in the future, hold a monopoly position in the world’s supply of advanced microelectronics.

Policies: Carrots and Sticks

The US needs a comprehensive national microelectronics strategy that responds to the changing geopolitical landscape. Policies need to be enacted that provide for assured access and trusted supplies. The same is true for other critical supply lines, but the characteristics of the semiconductor business are sufficiently different from other sectors that a unique approach is needed.

Typically, fabs take many years to build and require massive investments (tens of billions of dollars).15 Further, they are only economically viable if they maintain a large market share and have a sufficiently long lifespan over which to amortize their high costs. Accordingly, fixing the microelectronics supply chain problem requires a long-term approach that uses both carrots and sticks to steer the microelectronics industry. Separate proposals exist for each.

The DoD has a requirement for a “Program Protection Plan” within all major defense acquisition programs.16 That plan should ensure that all microelectronics used in a weapon system are procured through secure channels. The Potomac Institute, many years ago, recommended that FPGAs (microelectronics that are post-fabrication programmable) be bought by those programs from sources manufactured domestically, thereby creating a compulsory demand signal (a version of a “Buy America Act”).17 At the time, there were no domestically produced FPGAs.18 A “Buy America Act” for all major DoD acquisitions would not provide a large enough market. Alan Shaffer, the former Deputy Under Secretary for Acquisition and Sustainment, has argued that domestically sourcing all microelectronics purchased for critical US systems—whether a weapon system, a US government desktop computer, or a node in the domestic electric grid—would constitute a much larger market that, if instituted over time, could create a sufficient demand for secure domestic microelectronics.19 This regulation, which would be imposed as a “stick,” could be justified on national security grounds. The US government could be yet more aggressive, although sweeping “Buy America” acts are considered anti-competitive, inefficient, and in violation of World Trade Organization rules.20

In the realm of carrots, one concept is to meet foreign subsidies with our own. Such legislation has been proposed in the US Congress.

The CHIPS Act, “Creating Helpful Incentives to Produce Semiconductors,” proposes $52 billion through 2026 “to stimulate advanced chip manufacturing, enable cutting-edge research and development, secure the supply chain and bring greater transparency to the microelectronics ecosystem, create American jobs, and ensure long-term national security.” The act passed the US Senate in June, 2021,21 as part of the US Innovation and Competition Act (USICA),22 and includes funding for the formation of a public-private partnership (PPP) called the National Semiconductor Technology Center (NSTC).23 USICA also addresses other technology sectors, with an additional $190 billion over several years. As of this writing, the proposed legislation has not passed the US House of Representatives. Other proposed legislation, such as the Facilitating American-Built Semiconductors (FABS) Act, would provide tax credits to incentivize American semiconductor manufacturing.24 These legislative proposals are strongly supported by the Semiconductor Industry Association (SIA)25 and have bipartisan support. They are nonetheless controversial,26,27 as they single out particular technologies as “worthy” of advantageous “industrial policy” that amounts to welfare for certain corporate sectors.28 China opposes the acts.29

The use of PPPs has historically been an effective method to help strengthen the economic competitiveness of the domestic semiconductor industry. In the 1980s and 1990s, the US government helped foster “Sematech,” a consortium of semiconductor industries that pooled research and development.30 The lessons learned from the Sematech experience should be incorporated into any new microelectronics focused PPP such as the NSTC. An appropriate research focus is important, in this case post-Moore technologies such as advanced packaging and cost-effective custom chip fabrication. The governing structure is also crucial where the independence of the managing organization from individual member desires is essential for long-term success. A PPP such as the proposed NSTC should have clear commercial transition paths for new technologies.

Under a PPP program today, government engineers could work collaboratively with industry experts to develop tailored semiconductor products. Chips with added security would be an especially welcome product that would satisfy needs across the DoD and other security conscious markets. Many critical infrastructure sectors outside of government exist, including sectors such as banking, the power grid, water utilities, medical providers, special communications, and transportation. Taken together with the DoD, these areas could represent a major and viable new premium market for more secure semiconductor hardware. The National Defense Industry Association suggests that this approach could satisfy 20-25% of world demand for secure microelectronics.31

US Air Force Research Lab scientists independently produced a government-owned design, and manufactured a chip for defense applications.32 If such a program were scaled up with state-of-the-art technology and produced in conjunction with domestic fabs, a PPP with US industry might create a sustainable business. The US government could then ensure its position as first-in-line for acquisition and distribution of products. We have emphasized the US government and US industry roles, but it would also be important to work collaboratively with allies that have strong capabilities in the semiconductor fields (such as Taiwan and South Korea), encouraging them to locate facilities in the US.

Summary

The automobile industry and COVID-19 forced us to confront the fragility of the microelectronics supply chain. Whether for economic purposes or national security, guaranteed and secure access to advanced microelectronics is very important for the US. We hope that industry has learned the lesson of the vulnerability of “just-in-time” supply chain behavior for critical microelectronics. In the semiconductor industry, it is never wise to “lose one’s place in line” for critical parts, as this leads to long delays and shortages. But ultimately, this goes beyond commercial bottom lines and consumer satisfaction. America needs a comprehensive national strategy to ensure access to advanced and trusted microelectronics that can serve the needs of the government and industry, alike.

The semiconductor industry is highly globalized with key parts of the supply chain dominated by overseas players. Continued outsourcing threatens not only assured access, but also the nation’s place of relevance in a field we brought to fruition. The US is currently vulnerable to microelectronics supply chain disruptions, whether from a pandemic, sanctions, or conflicts. The US needs a comprehensive national strategy for microelectronics to ensure our security and economic prosperity.

Endnotes

1. Justin Metz, “Car Chip Shortage 2021: What’s Going On?” Erie Insurance (blog), January 28, 2022, https://www.erieinsurance.com/blog/car-chip-shortage-2021.

2. Michael Wayland, “Chip Shortage Expected to Cost Auto Industry $210 Billion in 2021,” September 23, 2021, https://www.cnbc.com/2021/09/23/chip-shortage-expected-to-cost-auto-industry-210-billion-in-2021.html.

3. Peter Maithel, “Global Microchip Shortage in Automotive Industry Reinforces Need for Better supply chain planning,” November 8, 2021, https://diginomica.com/global-microchip-shortage-automotive-industry-reinforces-need-better-supply-chain-planning.

4. Jeanne Whalen, “Semiconductor Shortage that has Hobbled Manufacturing Worldwide is Getting Worse,” The Washington Post September 23, 2021, https://www.washingtonpost.com/us-policy/2021/09/23/chip-shortage-forecast-automakers/.

5. Alan R. Shaffer, “A Microelectronic ‘Canary in a Coal Mine,’” Potomac Institute for Policy Studies, September 7, 2021 https://www.potomacinstitute.org/steps/featured-articles/september-2021/a-microelectronic-canary-in-a-coal-mine.

6. Zachary J. Lemnios, “US National Security in a New Era of Intense Global Competition,” Potomac Institute for Policy Studies, December 31, 2021 https://potomacinstitute.org/featured/2503-us-national-security-in-a-new-era-of-intense-global-competition.

7. Yasmin Tadjdeh, “Microelectronics Industry at ‘Inflection Point,’” National Defense Magazine October 1, 2020, https://www.nationaldefensemagazine.org/articles/2020/10/1/microelectronics-industry-at-inflection-point.

8. Sin-Young Park, “Samsung Surprises Foundry Industry with Plan for 2 nm Chips.” The Korea Economic Daily, October 10, 2021 https://www.kedglobal.com/newsView/ked202110100002.

9. Wei Sheng, “Where China is Investing in Semiconductors, in Charts,” March 4, 2021, https://technode.com/2021/03/04/where-china-is-investing-in-semiconductors-in-charts/.

10. Wei Sheng, “China Spends More Importing Semiconductors than Oil,” April 29, 2021, https://technode.com/2021/04/29/china-spends-more-importing-semiconductors-than-oil/.

11. “China’s New Semiconductor Policies: Issues for Congress,” Congressional Research Service, https://crsreports.congress.gov/product/pdf/R/R46767.

12. Peter Clarke, “TSMC, Nanjing sign to build Chinese Wafer Fab,” March 28, 2016, https://www.eenewsautomotive.com/news/tsmc-nanjing-sign-build-chinese-wafer-fab.

13. “The State Council Issued a New Era to Promote the Integrated Circuit Industry and Notice on Several Policies for High-Quality Development of Software Industry,” August 4, 2020, http://www.gov.cn/zhengce/content/2020-08/04/content_5532370.htm.

14. “ ‘Made in China 2025’ Plan Issued,” May 19, 2015, http://english.www.gov.cn/policies/latest_releases/2015/05/19/content_281475110703534.htm.

15. Aaron Gregg, “Samsung Plans to Build $17 Billion Chip Factory in Texas,” The Washington Post November 23, 2021, https://www.washingtonpost.com/business/2021/11/23/samsung-chip-factory-taylor-texas/.

16. Peter Merrill, Howard Harris, “Program Protection Plan,” Defense Acquisition University (blog), July 1, 2018, https://www.dau.edu/library/defense-atl/blog/Program-Protection-Plan.

17. Internal report and briefing at the Potomac Institute, briefed to senior DoD officials as FOUO pre-decisional reports, dated Feb 23, 2015, included the recommendation “Require that DoD FPGAs be purchased from Trusted sources for weapons and national security systems requiring Trust.”

18. Intel Corporation purchased Altera, an FPGA maker, in 2015, and so now there are some US fabs for FPGAs, despite the lack of a buy American policy.

19. Alan R. Shaffer, “A Microelectronic ‘Canary in a Coal Mine,’” Potomac Institute: STEPS, https://www.potomacinstitute.org/steps/featured-articles/september-2021/a-microelectronic-canary-in-a-coal-mine.

20. Rachel F. Fefer and Ian F. Fergusson, “Trade Implications of the President’s Buy American Executive Order,” CRS Insight May 2, 2017, https://sgp.fas.org/crs/misc/IN10697.pdf.

21. Mark Warner, “Bipartisan, Bicameral Bill Will Help Bring Production of Semiconductors, Critical to National Security, Back to U.S.,” June 20, 2021, https://www.warner.senate.gov/public/index.cfm/2020/6/bipartisan-bicameral-bill-will-help-bring-production-of-semiconductors-critical-to-national-security-back-to-u-s#:~:text=The%20CHIPS%20For%20America%20Act%3A%20Creates%20a%2040-percent,percent%20in%202026%2C%20and%20phases%20out%20in%202027.

22. S.1260 - 117th Congress (2021-2022): United States Innovation and Competition Act of 2021, https://www.congress.gov/bill/117th-congress/senate-bill/1260.

23. “Schumer Brings Commerce Secretary Gina Raimondo to Meet with IBM & Other Albany Nanotech Complex Stakeholders & Discuss Cutting-Edge Semiconductor R&D Happening in Albany; Senator Says Albany Ideal for Future National Semiconductor Technology Center That Would Bring 1000+ Jobs to Capital Region,” July 22, 2021, https://www.schumer.senate.gov/newsroom/press-releases/schumer-brings-commerce-secretary-gina-raimondo-to-meet-with-ibm-and-other-albany-nanotech-complex-stakeholders_discuss-cutting-edge-semiconductor-rd-happening-in-albany-senator-says-albany-ideal-for-future-national-semiconductor-technology-center-that-would-bring-1000-jobs-to-capital-region.

24. S.2107 - 117th Congress (2021-2022): The Facilitating American-Built Semiconductors (FABS) Act, https://www.congress.gov/bill/117th-congress/senate-bill/2107?s=1&r=68.

25. “CHIPS for America Act & FABS Act,” Semiconductor Industry Association, https://www.semiconductors.org/chips/.

26. George Calhoun, “Semiconductors – The CHIPS Act: What It Is (Part 1),” Forbes Nov 23, 2021, https://www.forbes.com/sites/georgecalhoun/2021/11/23/semiconductors--the-chips-act-why-it-is-what-it-is-part-1/?sh=52812bd64a8e.

27. George Calhoun, “The CHIPS Act: Good Questions, Bad Questions, Bad Bets? (Part 2),” Forbes Nov 27, 2021, https://www.forbes.com/sites/georgecalhoun/2021/11/27/the-chips-act-good-questions-bad-questions-bad-bets-part-2/?sh=54d35cef6cc5.

28. “Are Proposed US and EU “CHIPS Acts” Already Outmoded and Irrelevant?” Lexology, https://www.lexology.com/library/detail.aspx?g=9d876396-05ae-4cd4-bac5-699ce4b751d0.

29. David Shepardson, “U.S. Senate Passes Sweeping Bill to Address China Tech Threat,” Reuters June 9, 2021, https://www.reuters.com/world/us/us-senate-set-pass-sweeping-bill-address-china-tech-threat-2021-06-08/.

30. Robert D. Hof, “Lessons from Sematech.” MIT Technology Review July 25, 2011, https://www.technologyreview.com/2011/07/25/192832/lessons-from-sematech/.

31. “How to On-Shore Critical Semiconductor Production, Secure the Supply Chain, and Provide Access for the Industrial Base,” NDIA: Electronics Division, February 2021, https://www.ndia.org/-/media/sites/ndia/divisions/electronics/images---resources/ndia-on-shore-semiconductor-products-supply-chain-and-industrial-base-white-paper-final.ashx.

32. “AFRL Information Directorate Overview.” AFRL, https://www.afrl.af.mil/Portals/90/Documents/RI/AFRL-RI%20Overview%2088ABW-2020-2625-200924.pdf?ver=KGbkHUDQPpTmag1mU-95RA%3d%3d.